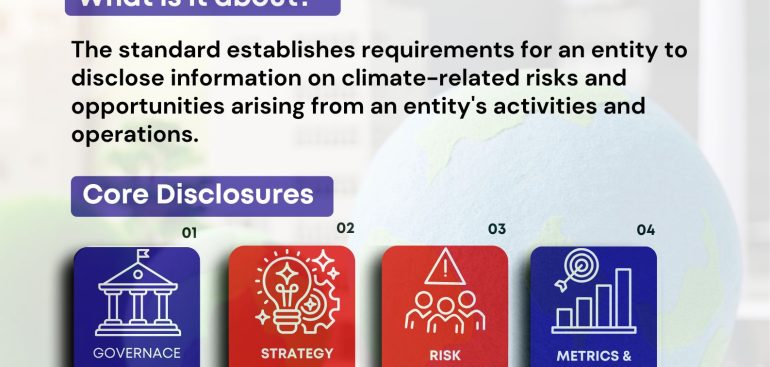

The standard sets out requirements for entities to disclose information on climate–related risks and opportunities arising from their activities and operations. It provides disclosures on governance, strategy, risk management, and metrics and targets.

The new standard comes at a time when climate change poses serious financial, operational, and service-delivery risks to the country. To protect citizens and manage public resources, the government is required to respond quickly to climate change in a structured and accountable manner, disclosing climate-related issues in its books of account.

“The IPSASB SRS 1 requires public sector entities to report on how climate affects their operations. This standard will be effective globally on 1st January 2028, while in Kenya it will be effective on 1st July 2028; however, early adoption is permitted,” PSASB CEO, FCPA Georgina Muchai said.

By applying the standard, public sector entities will be required to disclose their exposure to climate risks, including extreme weather, rising costs, and infrastructure damage, as well as any opportunities, such as renewable energy and climate-resilient investment. The entities will also be required to report on climate policies, projects, and programs, and on whether these are delivering results.

The disclosures are designed to improve decision-making and accountability. When climate information is consistent, comparable, and verifiable, parliament, auditors, donors, and the public can see how effectively public funds are spent to manage climate risk and support sustainable development. This also strengthens government credibility when seeking funding from development partners.

“Due to the unique nature of the Public Sector, the IPSASB is currently working on another standard to provide guidance for reporting on Public Policy Programs and their outcomes,” FCPA Georgina said.

PSASB is currently reviewing the standard and will offer training, guidelines, and reporting templates to help public sector entities comply.