To strengthen financial accountability and transparency in government, the Public Sector Accounting Standards Board (PSASB) has released four guidelines on new accounting standards, applicable to all public sector entities from 1 July 2025.

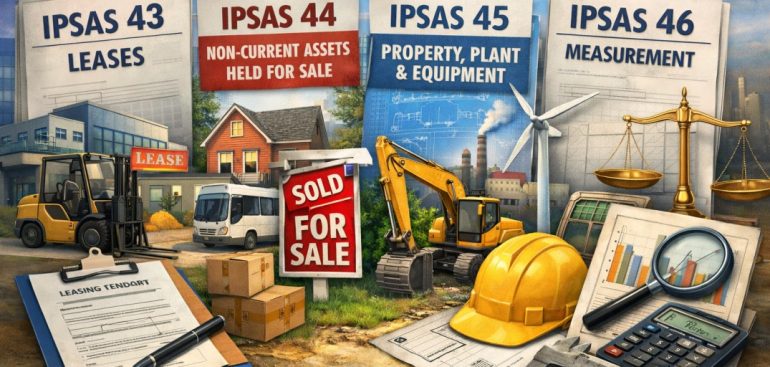

These new standards issued by the IPSASB will apply to national and county governments, state corporations, public universities, and other public sector entities. These are: IPSAS 43 on Leases, IPSAS 44 on Non-Current Assets Held for Sale, IPSAS 45 on Property, Plant, and Equipment, and IPSAS 46 on Measurement. The standards are expected to improve financial reporting, strengthen accountability for public resources, and promote more prudent decision-making by government institutions.

IPSAS 43 on leases sets out how government entities should account for leased assets such as office buildings, vehicles, and equipment. In the past, such arrangements were often expensed, making it difficult for citizens or oversight bodies to know the actual value of leased assets and obligations. This standard now requires government entities to clearly record leases as either assets or liabilities, showing precisely what the government owes or owns.

“The four are new accounting standards issued by International Public Sector Accounting Standards Board (IPSASB) and adopted in Kenya starting 1st July 2025 as part of the government’s transition to accrual-based accounting. With IPSAS 43, all lease obligations will be recognised, giving a clearer picture of the government’s financial position. IPSAS 44 provides principles for recognizing, measuring, presenting, and disclosing property, plant, and equipment (PPE) used by public sector entities to deliver services. IPSAS 45 will help the government manage assets better, plan maintenance, and avoid wastage; and finally, IPSAS 46 provides a comprehensive framework for how public sector entities should measure assets, liabilities, revenues, and expenses in their financial statements,” PSASB CEO FCPA Georgina Muchai said.

The second standard, IPSAS 44, focuses on non-current assets held for sale. These are government properties, such as land, buildings, or vehicles, that are no longer in use and are earmarked to be sold. The standard provides guidelines for valuing and presenting such assets before disposal.

This is particularly important in a country where idle or abandoned public property often goes unnoticed. IPSAS 44 ensures such assets are properly documented and that any sales benefit the public purse.

Every year, billions of shillings are spent on constructing roads, schools, hospitals, and other public facilities. IPSAS 45 provides a clear framework for the recording, measurement, and presentation of these properties, plants, and equipment.

With this standard, the government will have a more accurate picture of the value of the infrastructure it owns. This is expected to enhance planning, budgeting, and investment decisions, ensuring that public funds are well utilized and assets are maintained responsibly.

IPSAS 46 on measurement is a cross-cutting standard that deals with how assets and liabilities should be valued. It provides clear guidance on the use of fair value, historical cost, and other valuation techniques. This ensures that all public entities use consistent and credible methods to determine asset values, making financial reports more reliable.

The rollout of these standards is part of Kenya’s broader public finance reforms aimed at improving accountability and service delivery. FCPA Georgina added that the standards will enhance the credibility of government financial statements, making them more aligned with international best practices.

“These standards may sound technical, but their impact is efficient,” FCPA Georgina added. “They ensure that every building, vehicle, lease, and investment the government makes is properly recorded and accounted for. And that’s good for every taxpayer.”

PSASB in September conducted virtual sensitisation forums for all four standards. The guidelines are issued with the objectives of assisting preparers and users of financial statements to understand and implement the new standards within the Kenyan context.